R&D Tax Credits

R&D Tax Credits can be a great source of additional income that allows you to further develop ideas. You can claim these as either a cash payment, or a Corporation Tax reduction. When discussing your company’s R&D Tax Credits, we’ll assess which option would be better suited to your particular situation.

What is the definition of R&D?

HMRC and the Department of Trade and Industry have issued some guidance on the meaning of R&D for tax purposes.

For an activity to be considered as R&D it should aim to do the following:

- Seeking an advance in science or technology

- Attempting to resolve scientific or technological uncertainties

- Developing new & innovative products, processes or services

- Enhancing or appreciably improving existing ones

Schemes

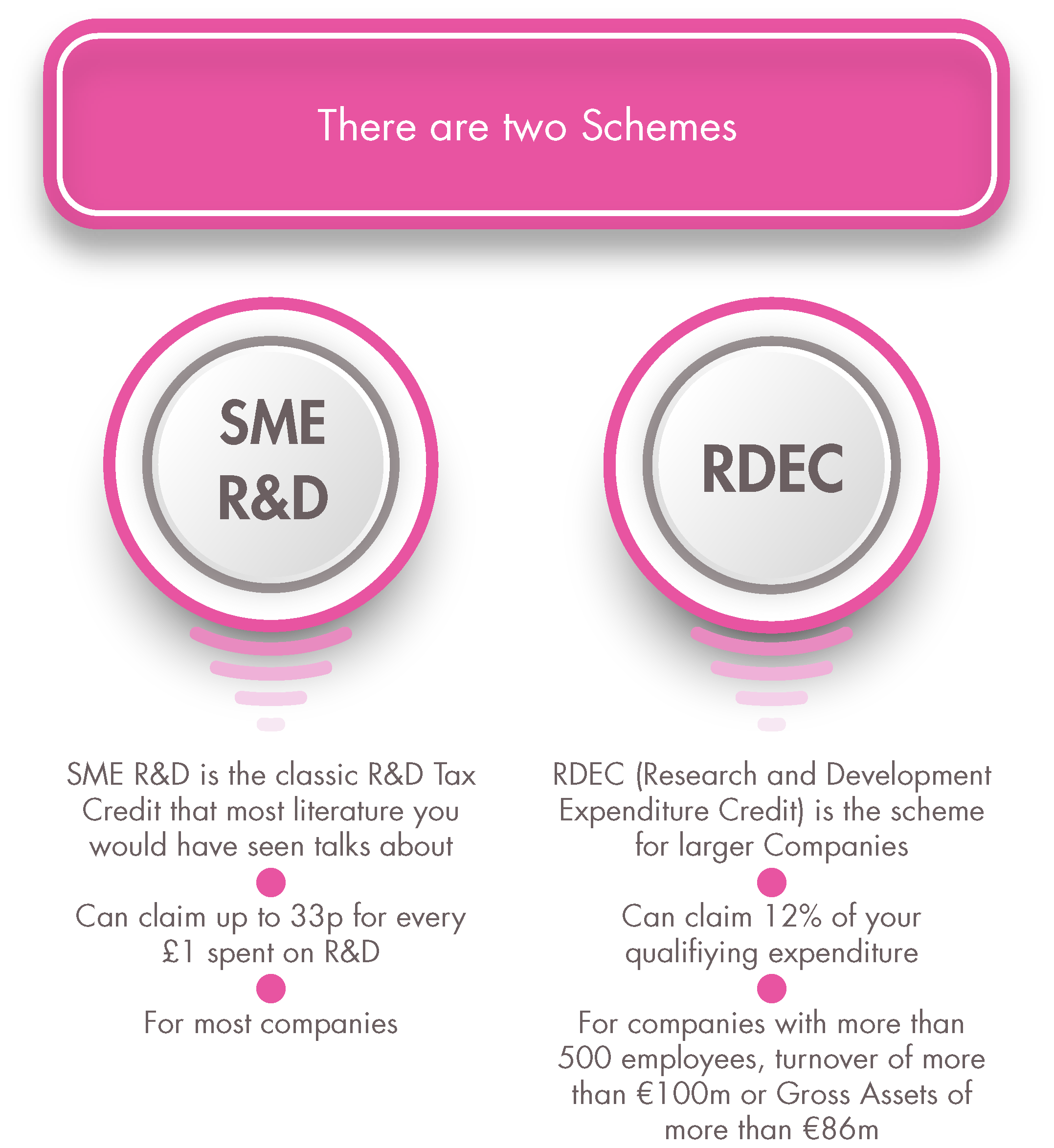

There are two schemes that exist for Small & Medium Enterprises (SME R&D) and one that exists for larger companies – Research & Expenditure Development Credit (RDEC).

What expenses can be claimed back?

Can Capital Costs be claimed?

Capital costs aren’t able to be claimed under this relief, but you may be able to claim them through your Annual Investment Allowance. We can help you to understand what you’ll be able to claim once we have undertaken an assessment of your R&D claim.

Grants

You can still claim R&D tax relief if you have received a grant – contact us for more information.

Advance Allowance

If you are making your first claim, then you could qualify for Advance Assurance. This means that for the first three accounting periods, your claim will be allowed without further enquiries from HMRC. You can do this at any time before your first claim and if you don’t do it, you can still claim the credit regardless.

Start your claim now

For more details and to get your claim started, please call the team on 01275 867350 or send us a message now.

Could you be eligible for Creative Industry Tax Relief too?

Creative Industry Tax Relief (CITR) is a government scheme that allows UK film and TV production firms, game developers and other creative bodies to apply for tax relief funding from HMRC. If this includes you, then you could be eligible.

Contact