Are you Eligible?

HMRC states that:

“Work that advances overall knowledge or capability in a field of science or technology, and projects and activities that help resolve scientific or technological uncertainties, may qualify for R&D relief. The relief is not just for ‘white coat’ scientific research but also for ‘brown coat’ development work in design and engineering that involves overcoming difficult technological problems.”

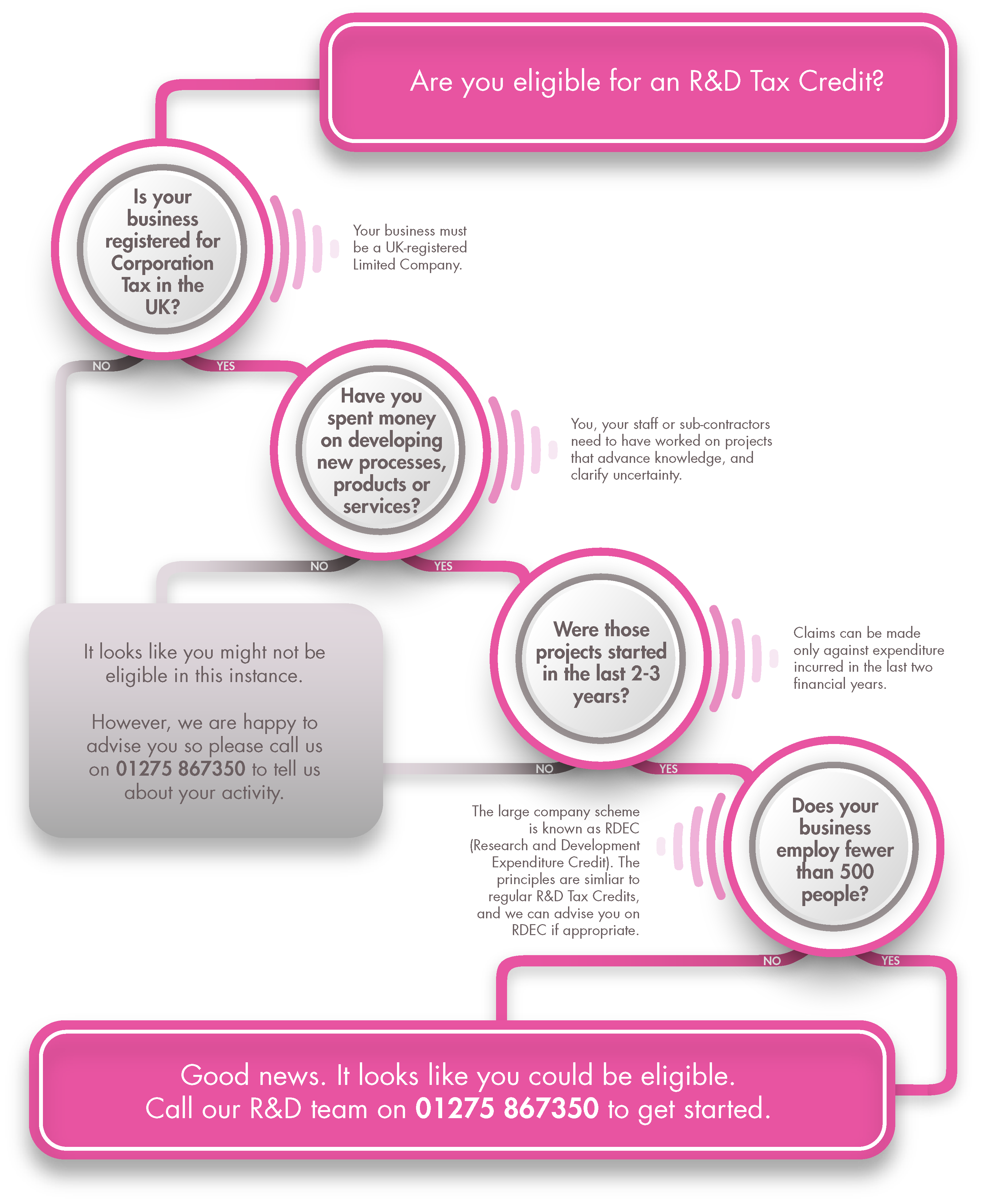

If you think you might be eligible, ask yourself the following questions:

- Is my business a Limited Company, registered in the UK?

- Does my company have a project or have we incurred expenditure on one in the last couple of years?

- Are we seeking an advance in a field of science or technology?

- Does the advance extend the overall knowledge or capability in the field of science or technology, and not just the company’s own state of knowledge or capability?

- Does the project involve an uncertainty that competent professionals can’t readily resolve and where solutions aren’t common knowledge?

If you can answer ‘Yes’ to all these questions, then you should be able to make a claim.

Start your claim now

For more details and to get your claim started, please call the team on 01275 867350 or send us a message now.

Contact

Could you be eligible for Creative Industry Tax Relief too?

Creative Industry Tax Relief (CITR) is a government scheme that allows UK film and TV production firms, game developers and other creative bodies to apply for tax relief funding from HMRC. If this includes you, then you could be eligible.