R&D Tax Relief Update – March 2021

The Budget on 3 March did not contain any measures to legislate for an increase in the R&D tax relief available under either the SME scheme or the R&D expenditure credit (RDEC) scheme. Instead, the previously announced SME cap will go ahead, and announcements...

Finch & Associates are taking on Cryptocurrency tax clients.

Cryptocurrencies are becoming increasingly popular as part of an investment portfolio for individuals. Despite this, the tax implications of making such investments are not commonly known, therefore it is important that you take professional advice from qualified and...

All you need to know about R&D Tax Credits – Interview with Business Leader Magazine.

We realised that many companies, particularly small ones, have no idea that what they’re doing could qualify as Research and Development and be eligible for R&D Tax Relief. Last month, we took part in a live Q&A event with Business Leader Magazine in which...

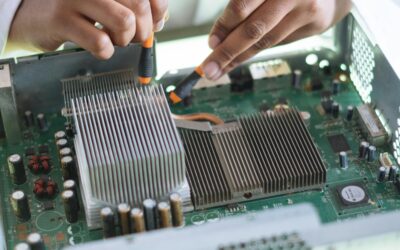

The role of R&D Tax Credits in the Manufacturing Industry

The role of research and development in the Manufacturing Industry has never been as important as it is today. In a world of interconnected devices and smart factories, the ability of a manufacturer to innovate and adapt to its customers’ requirements is vital....

The UK Government’s new R&D Road Map – A vision for a more innovative Britain?

On July 1 the Department for Business, Energy & Industrial Strategy (BEIS) published its R&D Roadmap, a 60-page paper outlining the government’s vision for cultivating a more science and technology-focused economy. But what does this Roadmap propose?...

No better time to investigate if your company is eligible for R&D Tax Credits.

Figures released by HMRC have revealed three sectors continue to dominate and reap the majority of R&D Tax Credit benefits; ‘Manufacturing’, ‘Professional, Scientific & Technical’ and ‘Information and Communications’. However, in light recent announcements by...

R&D Tax Relief Claim Process in the UK.

Claiming R&D tax relief in the UK can sometimes seem a little daunting especially for companies that have not done so before. While claiming R&D tax relief can be very worthwhile, in many cases companies are not doing so due to confusion around the process. We...

CORONAVIRUS: How will my R&D Tax Credits Claim be affected?

The Coronavirus pandemic has created lots of uncertainty, particularly around company finances and government funding. Many clients are asking about the impact on the R&D Tax Credits scheme. We have tried to answer your questions below, however the situation is...

Tax breaks every small business should know about

Especially in these uncertain times it is vital that small and medium sized businesses take full advantage of any tax relief available to them. You could add thousands of pounds to your business bottom line by applying these tax breaks. With understandably all...

Budget 2020: Good news for companies claiming R&D Tax Reliefs

As part of yesterday's Budget, Chancellor Rishi Sunak has increased the rate of R&D Expenditure Credit (RDEC) from 12% to 13% from 1 April 2020, supporting businesses investing in research and development (R&D) and helping to drive innovation in the economy....